VACANCY RATE VS. LEASE RATE

At year end, 2,761,000 square feet of space was under construc- tion within the geography tracked in this report, down from 3.2 million at mid-year. Most all the space under construction was built-to-suit space. However, there were three speculative proj- ects underway, one in north Toledo, one in Oregon and one in northern Wood County. Additionally, there was another 1 million square feet of space under construction in outlying counties of northwest Ohio, much of which was speculative.

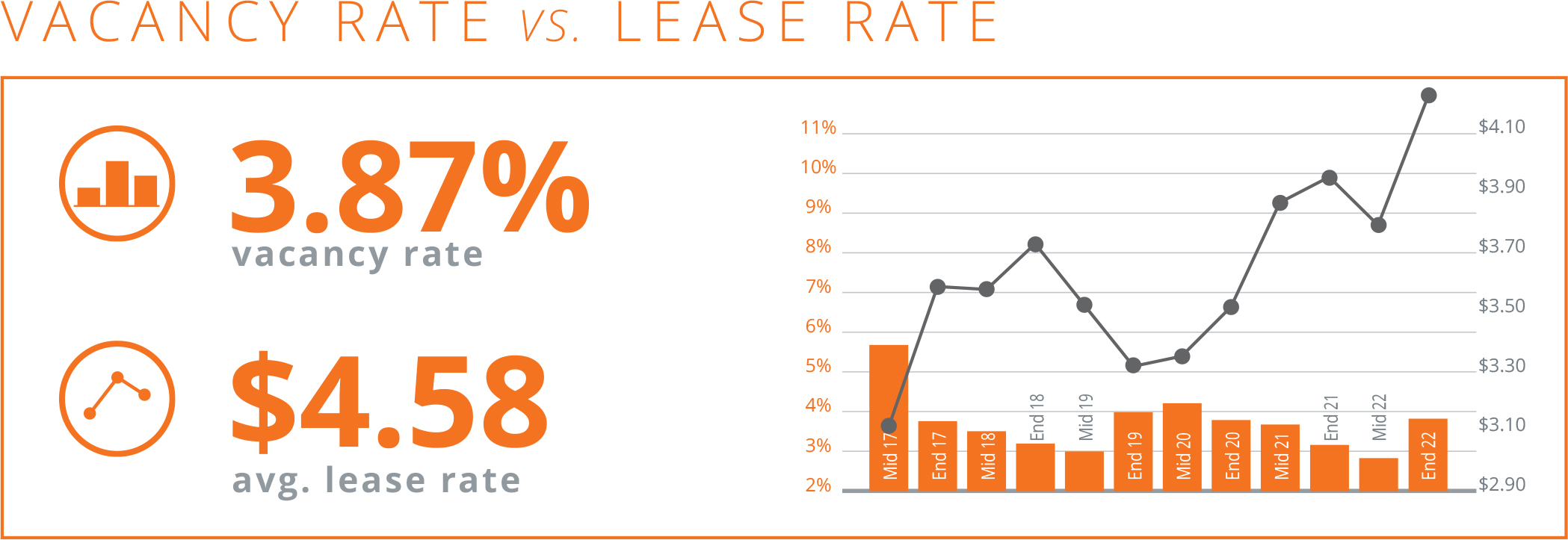

As has been widely reported elsewhere, Peloton suffered major financial difficulties in 2022 which, among other things, led it to cancel plans to occupy a facility then under construction in Troy Township in northern Wood County. The 1.2 million square foot building was delivered unoccupied and placed on the market for sale. Still the market was able to reach 3.5 million square feet of absorption in 2022. But, due to the Peloton situation, the overall market vacancy rate did increase to 3.78% at yearend 2022 from the historic low of 2.86% reached at mid-year. Were it not for the Peloton vacancy, the rate would have fallen yet again.

The average asking rental rate for the overall market increased dramatically in 2022 and stands at $4.58 per square foot, an $.81 increase in the second half of the year. Influenced by the spec space now being offered for lease, the average asking rate for Class A space reached $6.85 at year end 2022. Rental rate in- creases had been lagging the tightening and overall strengthen- ing of the regional industrial space market for the past several years. They seem finally to have responded to the rules of supply and demand. Though users may not like it, the increasing rates

are a great signal for the market. They are very important for at- tracting investors and developers and their capital to the market which will serve to sustain the market’s upward momentum. The increased rates make it easier to underwrite the speculative new construction that the market still needs to meet the demand from users we will otherwise lose to other markets if the space isn’t built and ready to occupy.

The nature of the users taking and looking for industrial space in the Toledo area continues to diversify and dilute the histori- cally strong influence that the auto industry has on the market. Toledo and northwest Ohio are finally being recognized for the benefits they offer distribution and logistics users and they have been very active. First Solar has added millions of square feet of manufacturing space for their solar panels and is adding another large research and development facility which is currently under construction. First Solar’s suppliers have also been consumers of space. Another example of the diversifying user base is Abbot Laboratories, which in December of 2022 announced its plans to build a new powdered formula manufacturing facility in Bowling Green, Ohio just south of Toledo along I-75.

As 2022 ended, site search and transactional activity remained robust and there is a solid pipeline of deals teed up for the com- ing year despite any anxiety about the near-term future direc- tion of the economy or rising interest rates.